On↔off ramp for PSPs,

OTC desks and EMIs

Trade and settle stablecoins and crypto within T+1 at institutional rates, seamlessly.

Partial pre-funding, no complex integrations, zero delays.

Trade and settle stablecoins and crypto within T+1 at institutional rates, seamlessly.

Partial pre-funding, no complex integrations, zero delays.

Total client trading volume since 2025

Institutional clients

Product

Get the trading infrastructure to handle your core business challenges

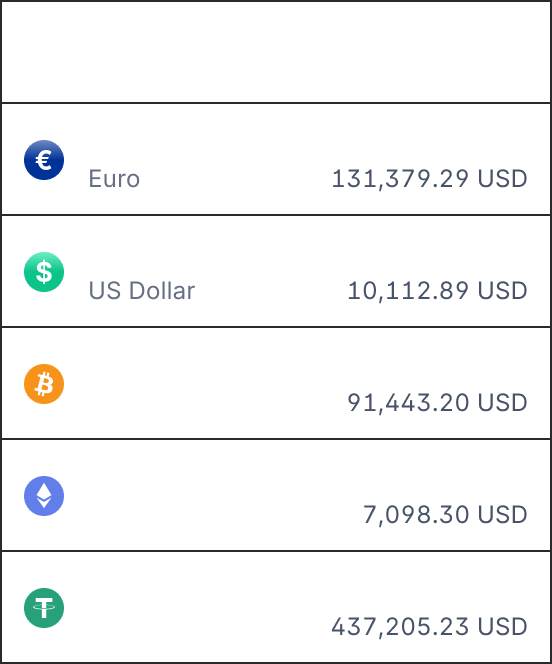

Institutional-grade pricing and tight spreads with elevated trading limits and reliable post-trade settlement.

Execute transactions of up to €10M seamlessly.

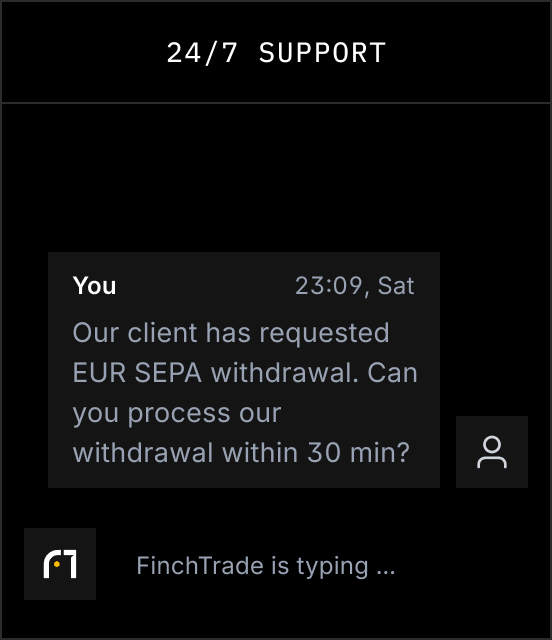

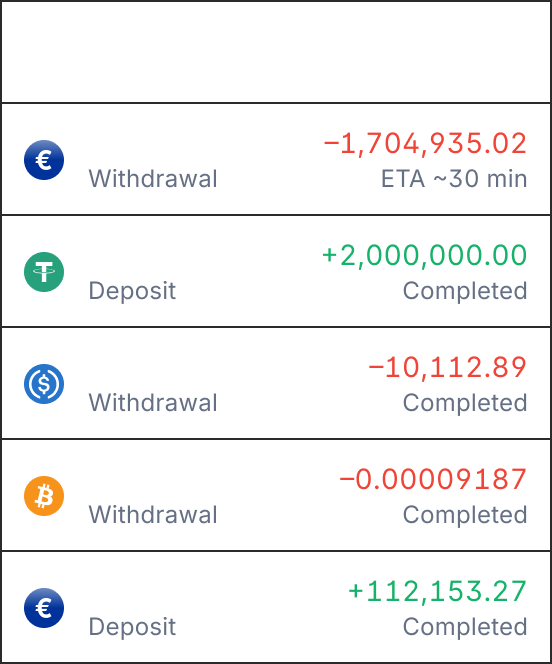

Average settlement in ~30 minutes, with withdrawals processed within 1–2 hours.

Available 24/7, so your funds move exactly when your business needs them — without unnecessary delays.

Start operating within 1–5 days through fully automated onboarding under the Swiss VASP licence.

A developer-friendly API with a live sandbox environment for immediate testing.

Automate onboarding, deposits, trading, and withdrawals end to end.

Sign up

~10 min

Questionnaire

1–2h

Online identification

~20 min

Sign T&C

~10 min

Challenges

Another LP

24:00:00Transfer sent

ETA ~30 min

Solutions

USDT/eur

0.30%

USDT/eur

0.30%

How FinchTrade beats CEXes & other OTC desks

Binance/Kraken/others

Average onboarding and

integration time

Average settlement time with

predictable performance

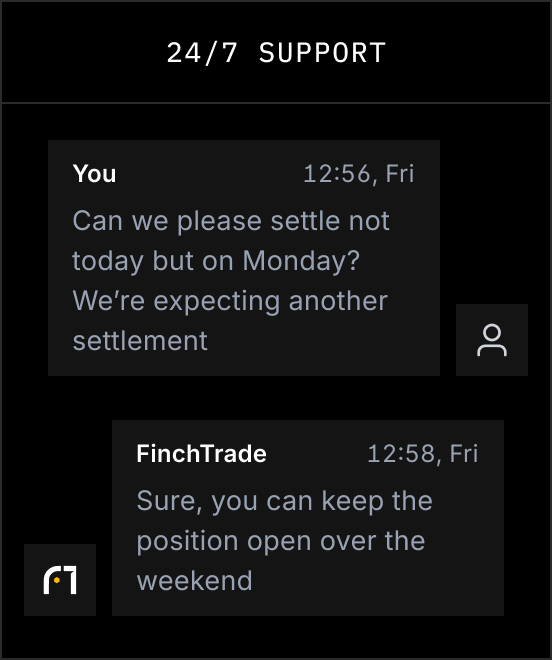

Instant access via Telegram

and email. No ticketing queues

Swiss VQF & VASP, certified to

ISO/IEC 27001 & ISO/IEC 27701

INXY enables seamless crypto acceptance, mass payouts, and currency conversions.

The key challenge is fast, competitive conversion to reduce volatility in time-sensitive payments.

FinchTrade has been instrumental in our growth. Their ability to provide deep liquidity and their flexibility in handling our specific needs have made them our go-to partner.

Cryptix is a B2B crypto payments provider for merchants.

The company faced fragmented liquidity, capital inefficiency caused by 100% pre-funding and high operational overhead from maintaining multiple LP connections

When selecting partners, we prioritize reliability, open communication, and mutual benefits. Ultimately, our decision led us to choose FinchTrade.

A European OTC desk serving institutional clients and HNWIs needed:

Partnering with FinchTrade has transformed how we operate. They understand the urgency and complexity of OTC trades and deliver pricing and execution we can trust. Our clients now get better fills, faster settlements, and full confidence.

INXY (PSP)

Cryptix (PSP)

OTC desk

Our services are not available to retail clients residing in, or corporate clients registered or established in, the United Kingdom, the United States, the European Union, or other restricted jurisdictions. Access to this website does not constitute an offer or solicitation to provide services in these jurisdictions.

The obtained data is processed in accordance with our Privacy policy

Kraken is optimized for convenience, not for institutional-scale execution and settlement efficiency.

On Kraken, you get:

Client example: a FinchTrade customer reduced settlement time from 6+ hours to ~30 minutes and lowered liquidity costs by 15%. Read the case study.

We’ve stripped out unnecessary friction.

Traditional process:

Our process:

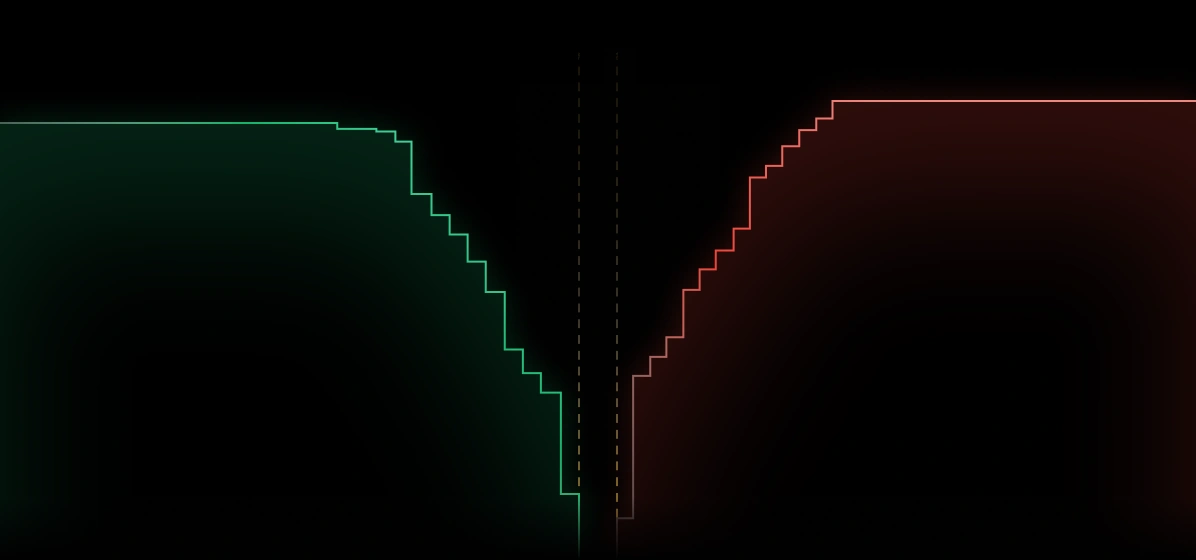

Post-trade settlement changes the game.

Traditional model:

FinchTrade’s model (post-trade settlement + flexible collateral):

Yes, if that's what you need. We offer two options, depending on your needs:

Option 1: Full API integration (most automated)

Time to production: 1-2 weeks

Use case: High-volume traders, PSPs, EMIs

Option 2: Managed service (manual trading at scale)

Time to setup: 1 day

Use case: Mid-size OTC desks with full manual control of all operations