Clear overview

Keep your open positions under control. View your current portfolio and floating

P&L in real-time

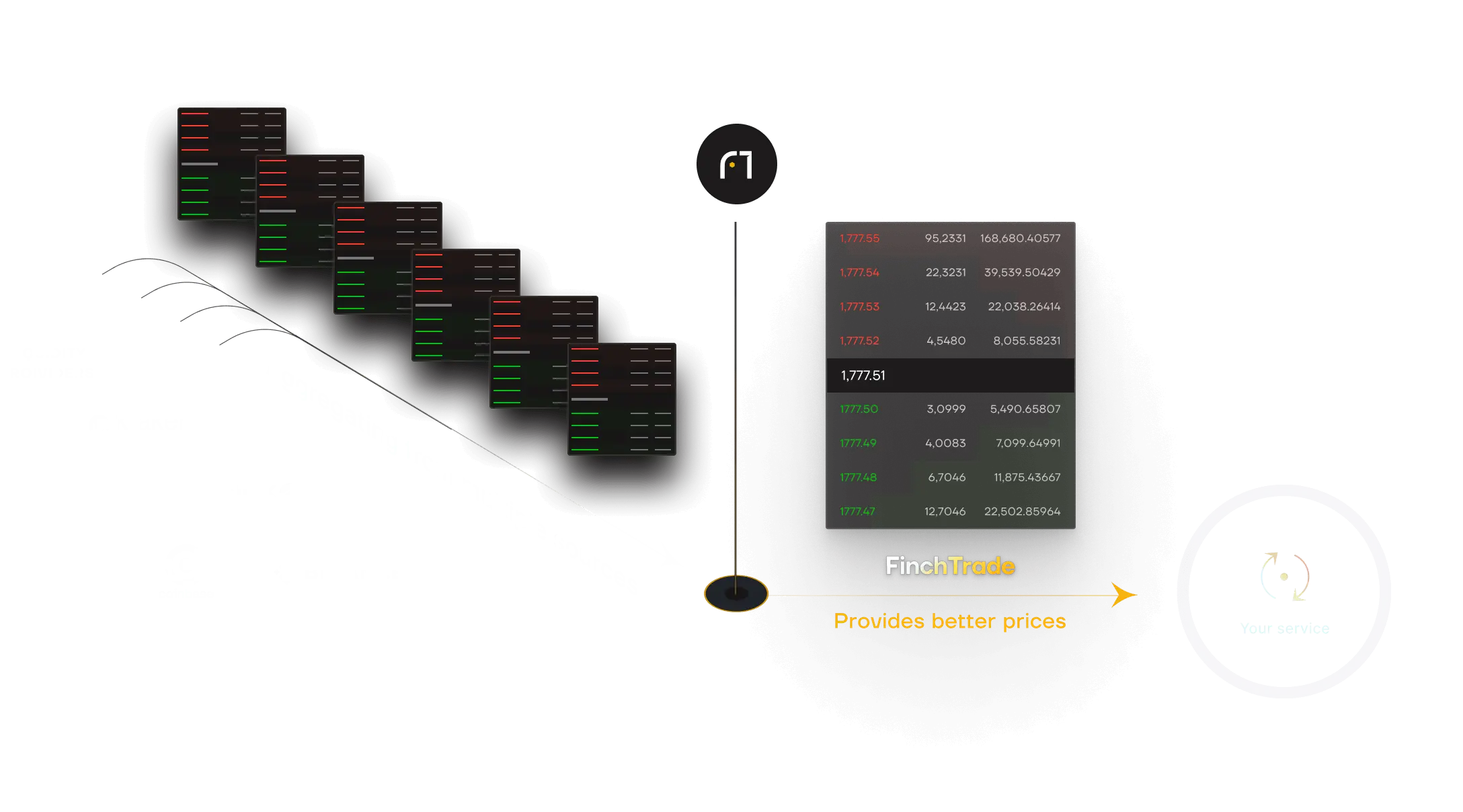

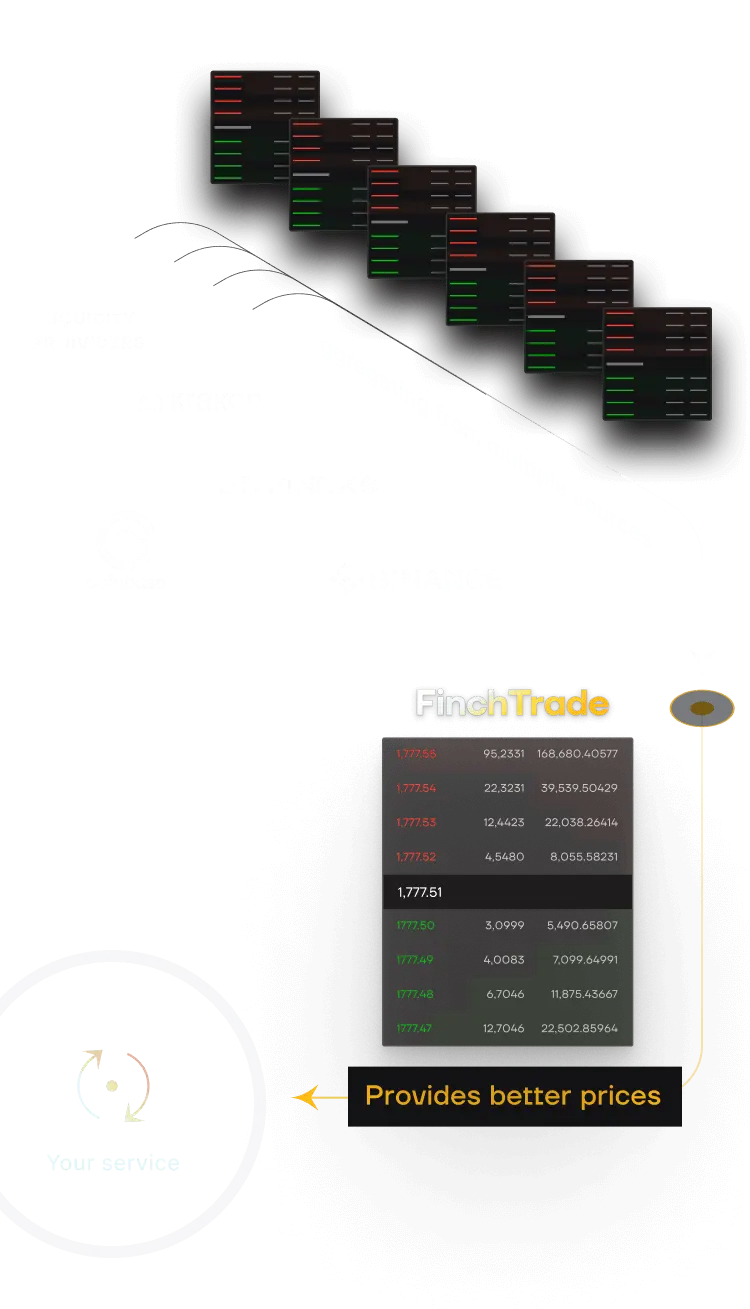

No last look

Execute large orders at once

Real-time prices

The price you see is the price you get with 0% rejection rates

Seamless execution of large block trades along with no restrictions on trade amounts

Real-time market data via WebSockets or FIX API

depending on an asset

Order execution: via web GUI or RESTful, WebSocket and FIX APIs

of both trading and post-trade settlement

real-time, daily & monthly trading statements

Hedge your position without settling it

EUR, USD, GBP, CHF,

AED etc

OTC LPs, European & US centralized exchanges

24/7 AML monitoring

Internal bank transfers are free, instant and available 24/7